The 21-7-71 Rule SIP is a powerful long-term investment strategy that shows how SIP investors benefit from compounding over a 21-year period.

🧠 What Is the 21-7-71 Rule?

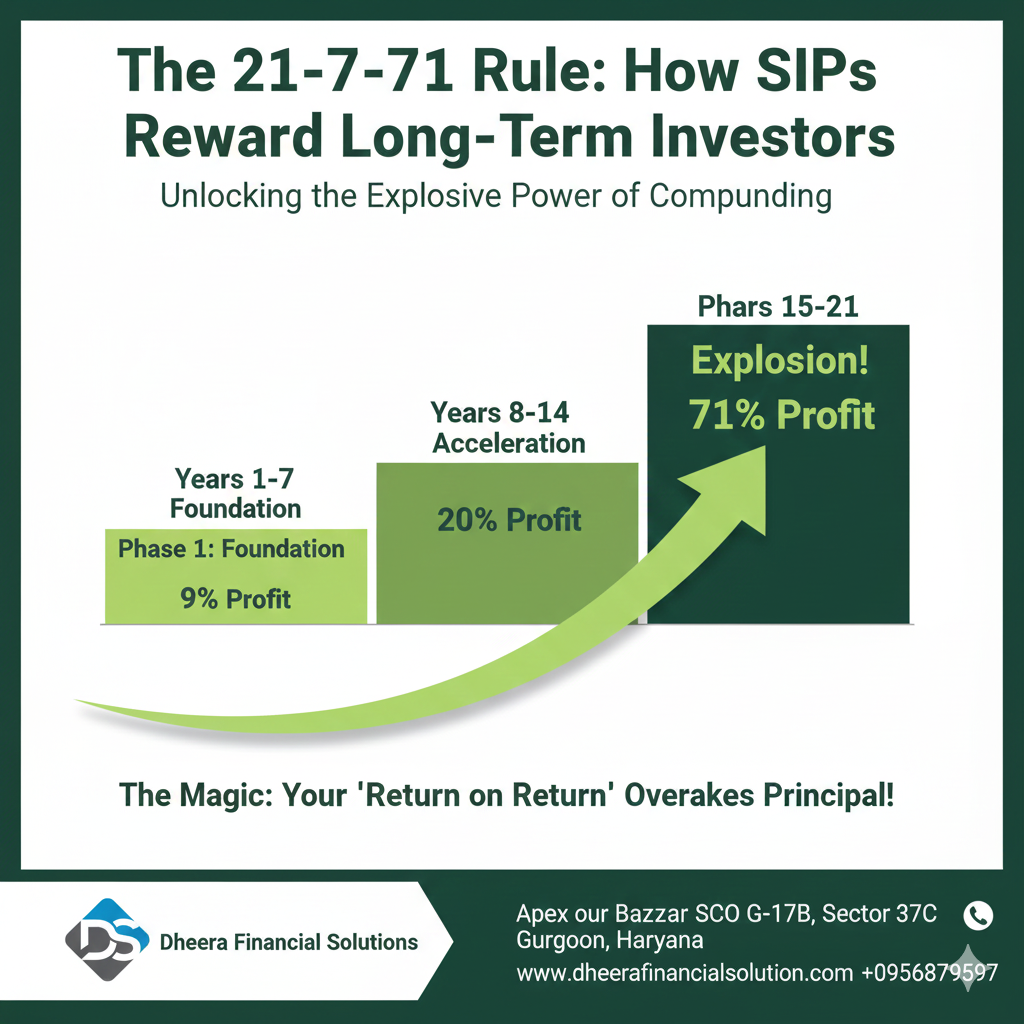

In the 21-7-71 Rule SIP, the investment journey is divided into three phases of seven years each, highlighting how patience rewards investors.

- First 7 years: Foundation phase — returns are modest

- Next 7 years: Growth phase — returns accelerate

- Final 7 years: Wealth explosion — 71% of total returns are generated

This rule highlights the magic of compounding, where time multiplies your money far more than effort

Understanding the 3 Phases of the 21-Year SIP

Imagine you run an SIP continuously for 21 years (assuming a 15% estimated return). We can divide this journey into three equal stages:

| Phase (Stage) | Time (Years) | Total Profit (%) | What is Happening? |

| Phase 1: Foundation | Years 1-7 | 9% | This is the time to build the base. Your capital contribution (principal) is high, and the profit earned is minimal (9%). |

| Phase 2: Acceleration | Years 8-14 | 20% | Growth picks up, but a large portion of your returns is still driven by your principal investment. |

| Phase 3: Explosion | Years 15-21 | 71% | This is the Compounding blast! Now, 71% of the profit comes from return on return, not from your original investment. |

The Power of Patience: Letting Your Money Overtake Your Efforts

The reason for this exponential growth is simple:

- Compounding starts working when your profits exceed your principal investment.

- In the early years, you are feeding the investment (principal). In the final years, the accumulated money grows rapidly, and you earn interest on that vastly increased corpus.

- This is the moment when Patience, Discipline, and Time deliver their ultimate reward.

The 3 Mistakes That Kill Compounding

Your growth can only be stopped by mistakes that break the compounding chain:

- Ignoring Index Funds: Many investors chase funds promising quick returns, but Index Funds have historically outperformed many actively managed funds over the long term.

- Stopping SIPs during Dips: When the market falls, stopping your SIP is the biggest mistake. You miss out on the chance to buy more units at discounted rates (Rupee Cost Averaging).

- Poor Portfolio Diversification: Putting all your money into a single fund or investment vehicle is risky.

🛡️ How Other Financial Products Complement Your SIP Strategy

- Life Insurance: Protects your family’s future while your investments grow

- Health Insurance: Shields your SIP from being interrupted by medical emergencies

- Motor Insurance: Prevents sudden vehicle expenses from derailing your financial plan

- Personal Accidental Insurance: Adds a layer of security against unforeseen injuries

- NPS (National Pension System): Builds retirement wealth alongside your SIPs

- Mutual Funds: SIPs are just one way to invest — explore equity, debt, hybrid funds for diversificatio

Key Lesson: Patience Is the Highest-Paying Asset

SIP is not about timing the market.

It is about time in the market.

Those who quit early miss the biggest rewards.

Conclusion

✔ The first 7 years test your patience

✔ The next 7 years build confidence

✔ The final 7 years deliver financial freedom

When combined with health insurance, term insurance, life insurance, personal accidental insurance, mutual funds, and NPS, SIP becomes a complete financial planning strategy—not just an investment.

Dheera Financial Solutions Building Trust, Building Wealth

📞 Call: +91-9911125221 📧 Email: dheerafinancialsolution@gmail.com 📍 Address: Apex our Bazaar SCO G-17B, Sector 37C Gurgaon, Haryana 🌐 Website: www.dheerafinancialsolution.com