Would you believe it?

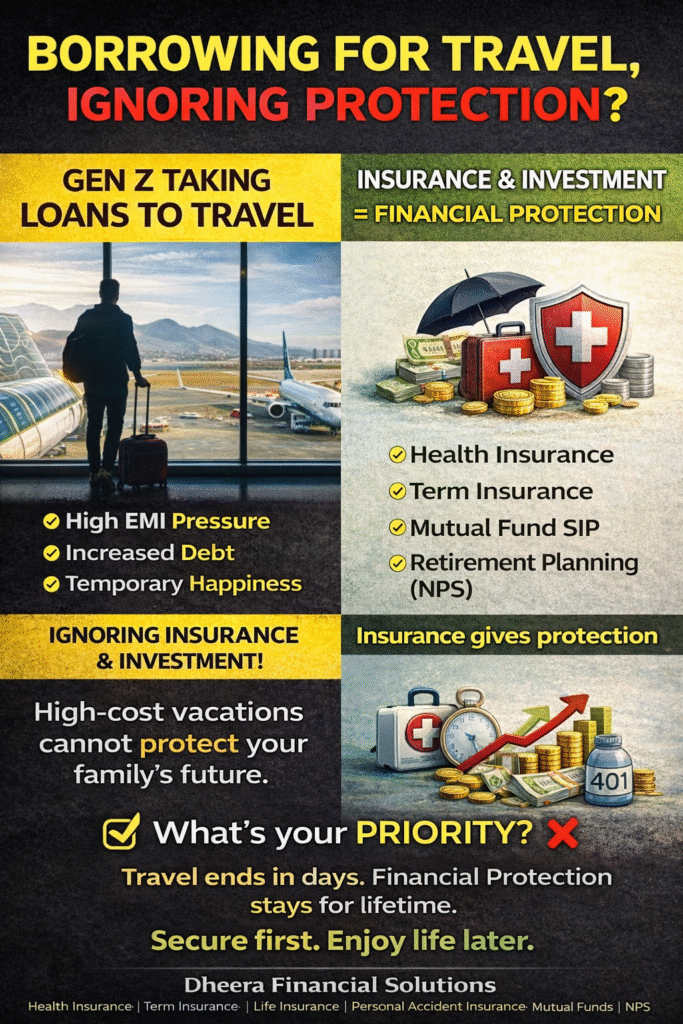

A growing number of Gen Z individuals are taking personal loans just to travel, post pictures on Instagram, and maintain a lifestyle image online. Recent trends show that a significant portion of personal loans are being used for travel and experiences, not for building assets or financial security.

Travel is beautiful. Experiences matter.

But borrowing money for temporary happiness—without securing your future—can silently damage your financial life.

The Hidden Cost of “Instagram Lifestyle”

When you take a personal loan for travel, you pay:

- High interest rates

- EMI pressure for years

- Reduced savings capacity

- Increased financial stress

The vacation ends in a few days, but the loan stays for years.

Ironically, many people hesitate when it comes to:

- Life insurance

- Term insurance

- Health insurance

- Personal accidental insurance

- Mutual fund SIPs

- Retirement planning through NPS

These are not expenses.

These are financial protection tools.

What Happens Without Insurance & Investment?

Life is unpredictable. A medical emergency, accident, or income loss can:

- Wipe out savings

- Force you to break investments

- Push you into debt again

- Delay long-term goals like retirement and children’s education

Health insurance protects your savings from rising medical costs.

Term insurance protects your family’s lifestyle if something happens to you.

Personal accidental insurance provides extra security against unforeseen accidents.

Without these, even a small emergency can undo years of hard work.

Experiences Are Good — But Stability Comes First

There’s nothing wrong with traveling or enjoying life.

The problem starts when:

- Lifestyle comes before protection

- Loans come before planning

- Social media validation comes before financial discipline

A smarter approach is:

- Secure yourself with health insurance & term insurance

- Build an emergency fund

- Start mutual fund SIPs for long-term wealth

- Plan retirement early through NPS

- Enjoy travel from savings, not loans

The Real Flex Is Financial Freedom

True success is not posting vacation pictures on borrowed money.

The real flex is having insurance, investments, and peace of mind.

Travel when you can afford it.

But protect your future first.

Because memories are temporary —

financial protection lasts a lifetime.

🎯 Final Thought

Travel is beautiful.

But financial protection is powerful.

Before you book your next trip, ask:

“Am I protected if something goes wrong?”

With Dheera Financial Solution, you can live fully — and plan wisely.